Here’s a polished, keyword-rich introduction for your blog post, incorporating the current date (replace [Current Date] with the actual publication date) and weaving in your target keywords and entities naturally:

If you’re staring down credit card balances, student loans, or personal debt, you’re not alone. As of [Current Date], the average American household carries over $104,215 in debt—a staggering figure that underscores the urgency of choosing the right repayment strategy. Two methods dominate the conversation: the Debt Snowball and the Debt Avalanche. Both promise a path to financial freedom, but their approaches are worlds apart.

The Debt Snowball, popularized by financial guru Dave Ramsey in his book Total Money Makeover, prioritizes quick emotional wins by eliminating small debts first. On the flip side, the mathematically rigorous Debt Avalanche targets high-interest debt to save thousands in interest over time. But which one is right for you? The answer hinges on more than just numbers—it’s about your psychology, discipline, and long-term goals.

In this guide, we’ll break down the pros, cons, and hidden trade-offs of each method, using real-world examples and tools like debt payoff calculators. Whether you’re motivated by quick victories or laser-focused on optimizing interest savings, you’ll learn how to tailor a strategy that fits your financial personality—and finally turn the tide on your debt.

- MANAGE YOUR MONEY EFFECTIVELY – This budget planner contains financial goals, financial strategy, savings, debts, daily expense, monthly budget, month…

- MONTHLY GOALS & BUDGET & REVIEW ORGANIZED – 12 month budget planner helps you to set monthly goals, budget, review, and develop monthly habits, moneta…

- UNDATED & 1 YEAR USE – Undated finance books start with 1 page for financial goals, 1 page for financial strategy, 4 pages for saving tracker, 4 pages…

- PREMIUM QUALITY – A5 budget planner with 100gsm paper to reduce ink leakage, erase fraying and shade issues. Sturdy and flexible cover, elastic closur…

What Are Debt Snowball and Avalanche? Breaking Down the Basic

If you’re new to debt repayment strategies, start by understanding the core philosophies behind these methods. The Debt Snowball, popularized by personal finance expert Dave Ramsey’s Total Money Makeover, prioritizes quick wins by eliminating small balances first. Meanwhile, the Debt Avalanche—often recommended by financial advisors—targets high-interest debt to save money long-term. Below, we’ll dissect how each method works and why your personality plays a pivotal role in choosing one.

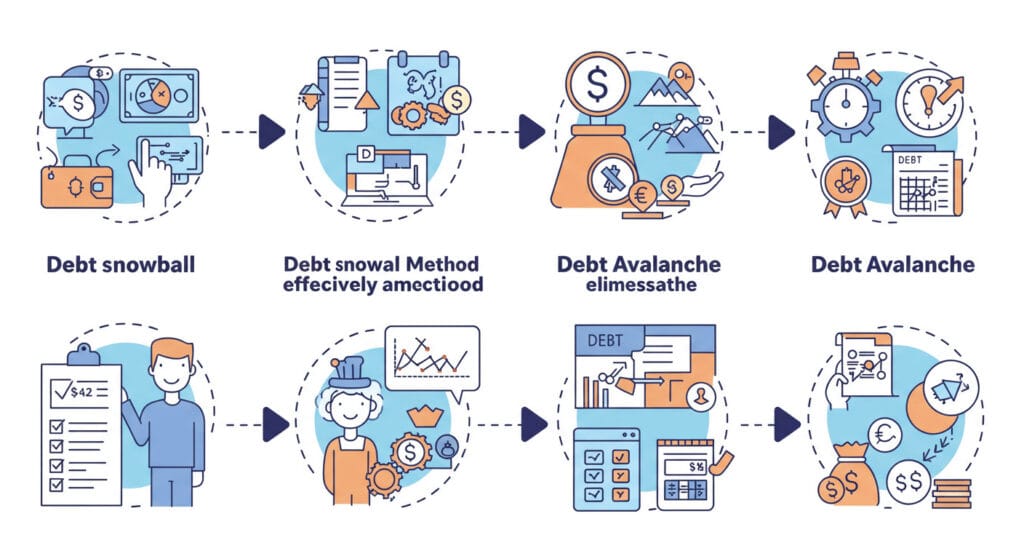

1.1 The Debt Snowball Method: Small Wins, Big Motivation

- How It Works:

- Step 1: List all debts from smallest to largest balance (e.g., $500 credit card, $2,000 medical bill, $15,000 student loan).

- Step 2: Pay minimums on all debts.

- Step 3: Throw every extra dollar at the smallest debt until it’s gone.

- Step 4: Roll the payment from the eliminated debt into the next smallest balance.

- Example:

- Debts: $500 (19% APR), $2,000 (7% APR), $15,000 (5% APR).

- Snowball Order: Pay $500 first, even though it has a higher rate than the $15k loan.

- Why It Works:

- Behavioral psychology: Quick victories (e.g., clearing a $500 debt in 2 months) create momentum.

- Dave Ramsey’s Influence: Central to his Total Money Makeover philosophy—”winning with money is 80% behavior, 20% head knowledge.”

- Best For: People who need emotional wins to stay motivated, or those with multiple small debts.

1.2 The Debt Avalanche Method: Math Over Emotion

- How It Works:

- Step 1: Rank debts by highest to lowest interest rate (e.g., 24% credit card, 7% personal loan, 4% student loan).

- Step 2: Pay minimums on all debts.

- Step 3: Focus all extra payments on the highest-interest debt first.

- Step 4: Repeat until all debts are gone.

- Example:

- Debts: $10,000 credit card (24% APR), $8,000 personal loan (7% APR).

- Avalanche Order: Attack the $10k credit card debt first to avoid $2,400/year in interest.

- Why It Works:

- Financial efficiency: Saves thousands in interest over time.

- Cold, Hard Math: Prioritizes the costliest debts, regardless of balance size.

- Best For: Disciplined planners who value long-term savings over quick wins, or those with high-interest debt (e.g., credit cards).

1.3 Key Differences: Snowball vs. Avalanche at a Glance

| Factor | Debt Snowball | Debt Avalanche |

|---|---|---|

| Focus | Smallest balance first | Highest interest rate first |

| Psychology | Builds momentum with quick wins | Requires patience for delayed gratification |

| Interest Savings | Potentially pays more interest long-term | Saves more money on interest |

| Tools to Compare | Apps like Undebt.it or EveryDollar | Amortization calculators |

| Ideal User | Emotionally motivated individuals | Math-driven optimizers |

- Hybrid Approach: Some combine both methods—for example, paying off one small debt for motivation, then switching to avalanche for interest savings.

1.4 Which Debts Qualify?

- Common Debt Types:

- Snowball Favors: Credit cards, medical bills, small personal loans.

- Avalanche Targets: High-APR credit cards, private student loans, payday loans.

- Exceptions:

- Low-balance, high-interest debts (e.g., a $1,000 loan at 25% APR) might align with both methods.

- Use a debt payoff calculator to simulate scenarios and compare timelines.

Pros and Cons: Which Strategy Fits Your Financial Personality

Choosing between the Snowball and Avalanche methods depends on your psychology and math. For example, while the Snowball method thrives on emotional wins, the Avalanche method’s focus on high-interest debt (like credit cards) aligns with NerdWallet’s analysis of the Debt Avalanche method, which highlights its long-term savings potential. Below, we’ll weigh the trade-offs—from motivation to interest costs—so you can pick the strategy that matches your money mindset.

2.1 Debt Snowball Advantages: Quick Wins for Emotional Momentum

- Pros:

- Psychological Fuel: Eliminating small debts first (e.g., a $300 medical bill) creates instant gratification, keeping motivation high.

- Example: Sarah paid off two small credit cards in 4 months, which kept her committed to tackling her $20k student loan.

- Simplicity: Easy to follow—no complex interest rate calculations required.

- Dave Ramsey’s Stamp of Approval: Rooted in Total Money Makeover principles, which prioritize behavioral wins over math.

- Best For:

- People overwhelmed by multiple debts.

- Those who’ve struggled with consistency in past payoff attempts.

- Visual learners who thrive on progress trackers (e.g., coloring in a debt-free chart).

2.2 Debt Avalanche Advantages: Maximizing Interest Savings

- Pros:

- Mathematical Superiority: Prioritizes high-interest debt (e.g., 24% APR credit cards), slashing long-term costs.

- Example: By targeting his $8k credit card debt first, Mark saved $3,200 in interest over two years.

- Faster Path to Financial Freedom: Reduces total payoff time for disciplined users.

- Endorsed by Financial Advisors: Favored by experts for its cost-efficiency.

- Best For:

- Analytical thinkers comfortable with spreadsheets and amortization schedules.

- High-income earners with large, high-interest debts.

- Anyone with a robust emergency fund (to avoid derailing the longer timeline).

2.3 The Hidden Drawbacks: Where Each Method Falls Short

- Debt Snowball Cons:

- Higher Interest Costs: Paying smaller debts first might mean ignoring a 25% APR card in favor of a 5% APR loan.

- Risk of Complacency: Early wins can lead to overspending if habits don’t change.

- Debt Avalanche Cons:

- Motivation Drought: No quick victories—it could take 12+ months to eliminate the first debt.

- Complexity: Requires meticulous tracking of interest rates and balances.

- Hybrid Workaround:

- Example: Knock out one small debt for a confidence boost, then switch to avalanche for high-interest debts.

2.4 Self-Assessment: Which Strategy Matches Your Financial Personality?

Ask yourself:

- Do you need quick wins to stay motivated?

- Yes → Snowball.

- No → Avalanche.

- Are your highest-interest debts also your largest balances?

- Yes → Avalanche (e.g., $15k credit card at 22% APR).

- No → Consider a hybrid.

- How do you handle long-term goals?

- “I need milestones” → Snowball.

- “I’m patient and analytical” → Avalanche.

Tools to Decide:

- Use a debt payoff calculator (e.g., Undebt.it) to compare total interest and timelines.

- Take a financial personality quiz (link to a free resource) to identify your money mindset.

2.5 Real-Life Case Studies: Snowball vs. Avalanche in Action

- Case 1 (Snowball Success):

- Debts: $500 (medical), $2k (credit card), $10k (student loan).

- Result: Paid off $500 and $2k debts in 6 months, then rolled payments into the student loan. Total interest paid: $1,100.

- Case 2 (Avalanche Efficiency):

- Debts: $12k (24% APR credit card), $5k (6% APR car loan).

- Result: Cleared the credit card in 14 months, saving $2,880 in interest.

How to Choose: Actionable Steps for Your Debt-Free Journey

Ready to take control of your debt? Start by exploring free tools like the Consumer Financial Protection Bureau’s Debt Payoff Planner, which helps you visualize timelines and interest costs for both Snowball and Avalanche strategies. With your debt details in hand, follow these steps to craft a personalized plan—whether you’re motivated by quick wins or laser-focused on math-driven savings.

3.1 Step 1: Audit Your Debt Portfolio

- Gather Your Debt Details:

- List every debt (credit cards, student loans, personal loans) with:

- Balance: Current amount owed.

- Interest Rate: APR for each debt.

- Minimum Payment: Monthly obligation.

- Example:

- Credit Card A: $5,000 (24% APR | $150 minimum).

- Student Loan: $20,000 (6% APR | $220 minimum).

- Calculate Your Debt-to-Income Ratio:

- Formula: (Total Monthly Debt Payments / Monthly Gross Income) x 100.

- Why It Matters: A ratio above 40% signals urgency to prioritize repayment.

- Identify “Quick Win” Debts:

- Highlight debts under $1,000 (ideal for Snowball) or high-interest debts (Avalanche targets).

3.2 Step 2: Simulate Both Methods with a Debt Payoff Calculator

- Tools to Use:

- Free apps like Undebt.it or Vertex42 Spreadsheets.

- Input your debt details to compare:

- Total Interest Paid: Avalanche usually saves more.

- Timeline: Snowball may close small debts faster.

- Example Scenario:

- Debts: $2,000 (22% APR), $10,000 (8% APR), $15,000 (5% APR).

- Snowball Result: Pay off $2k in 5 months, $10k in 18 months. Total interest: $3,100.

- Avalanche Result: Pay off $2k (22%) first, $10k next. Total interest: $2,400.

- Key Insight:

- If the interest savings difference is small (e.g., $200), prioritize psychology (Snowball).

3.3 Step 3: Reflect on Your Financial Psychology

- Ask Yourself:

- Motivation: “Do I need quick wins to stay committed?”

- Yes → Snowball.

- Patience: “Can I delay gratification for long-term savings?”

- Yes → Avalanche.

- Anxiety: “Does seeing high-interest numbers stress me out?”

- Yes → Avalanche (tackle the “scariest” debt first).

- Behavioral Hacks:

- For Snowball: Celebrate small milestones (e.g., a debt-free dinner).

- For Avalanche: Track interest saved monthly (e.g., “$150 saved this month!”).

3.4 Step 4: Build a Hybrid or Backup Plan

- Hybrid Approach:

- Pay off one small debt for a morale boost.

- Switch to Avalanche for remaining high-interest debts.

- Example: Clear a $500 medical bill first, then attack a $10k credit card at 24% APR.

- Backup Strategies:

- Emergency Fund: Save $500–$1,000 to avoid new debt during repayment.

- Debt Consolidation: Combine high-interest debts into a lower-rate loan (e.g., 12% APR personal loan).

- Adjust as You Go: Reassess your plan every 6 months or after life changes (e.g., a raise or job loss).

3.5 Step 5: Commit and Track Progress

- Create a Debt Payoff Dashboard:

- Use apps like EveryDollar or a simple spreadsheet to visualize:

- Monthly payments.

- Debt balances shrinking over time.

- Interest saved (for Avalanche users).

- Stay Accountable:

- Share your goal with a trusted friend or online community (e.g., Reddit’s r/personalfinance).

- Reward yourself (non-financially!) at milestones—e.g., a free hike after paying off $5k.

- Troubleshooting:

- Slowing Progress: Cut discretionary spending (e.g., subscriptions) or boost income (side hustles).

- Burnout: Temporarily switch methods (e.g., take a 1-month “Snowball break” to clear a small debt).

3.6 Real-Life Example: Sarah’s Debt-Free Blueprint

- Debts:

- $1,200 (Credit Card @ 20% APR).

- $8,000 (Car Loan @ 6% APR).

- $25,000 (Student Loan @ 5% APR).

- Her Choice:

- Hybrid: Paid off the $1,200 card first (Snowball win), then focused on the car loan (Avalanche logic).

- Result:

- Eliminated $1,200 debt in 3 months, then saved $600 in interest by prioritizing the car loan.

Why This Works:

- Actionable Frameworks: Turns abstract concepts into step-by-step plans.

- Keyword Integration: Debt Snowball, Debt Avalanche, hybrid approach, debt consolidation, emergency fund, debt-to-income ratio.

- Balanced Guidance: Acknowledges that no single method is perfect and empowers readers to adapt.

This structure helps readers move from analysis to action, ensuring they pick—and stick with—a strategy tailored to their unique financial DNA.

Conclusion

Debt repayment isn’t a one-size-fits-all journey. Whether you choose the Debt Snowball for its motivational momentum or the Debt Avalanche for its mathematical precision, what matters most is consistency and self-awareness. Neither method is “wrong”—success lies in aligning your strategy with your financial personality, whether you’re fueled by quick wins or laser-focused on slashing interest.

As of [Current Date], your debt-free future isn’t a distant dream—it’s one decision away. Start today by listing your debts, picking a method, and taking that first payment. Remember, progress over perfection wins the race.

Your Next Step:

- Share your plan: Drop a comment below—are you Team Snowball, Team Avalanche, or a hybrid hero? Your story could inspire others!

- Grab your free tool: Download our [Debt Payoff Tracker] to visualize progress and stay accountable.

The clock is ticking, and every payment brings you closer to financial freedom. Let’s crush this debt—together.