Landing a competitive finance internship isn’t just about luck—it’s a strategic process that demands preparation, persistence, and a deep understanding of what top firms like Goldman Sachs, J.P. Morgan, or BlackRock are looking for. With thousands of applicants vying for limited spots at prestigious companies, standing out requires more than good grades or a polished resume. You need a game plan that covers everything: from tailoring your application to mastering technical interviews, building a robust professional network, and showcasing the skills that make you indispensable.

The finance industry is notoriously selective, with internships often serving as a direct pipeline to full-time roles. Whether you’re eyeing investment banking, corporate finance, or financial analysis, the competition is fierce. For instance, top programs at firms like Morgan Stanley or Deloitte regularly see acceptance rates lower than Ivy League admissions. But don’t let that intimidate you—this guide is designed to demystify the process.

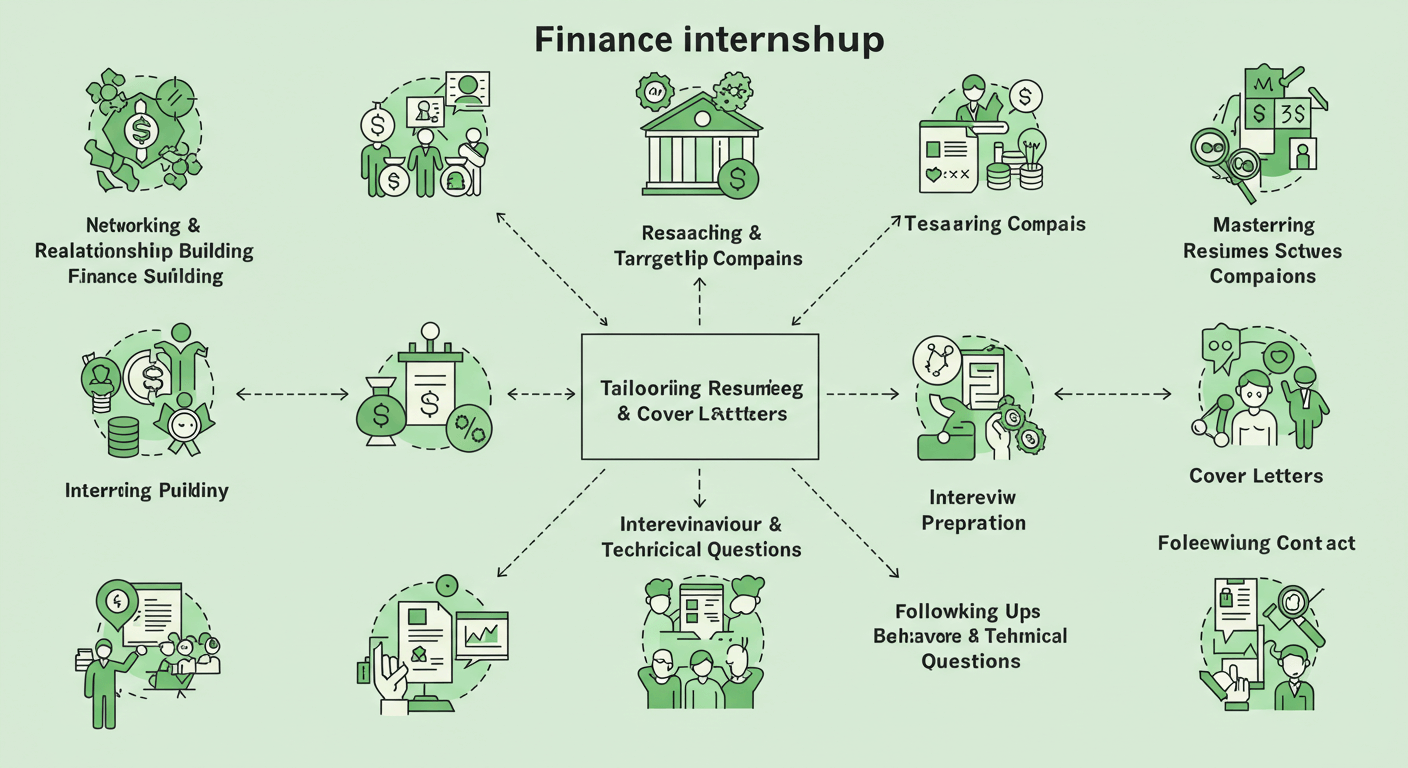

In this step-by-step roadmap, we’ll break down how to craft a finance-focused resume that highlights your Excel wizardry and financial modeling skills, ace behavioral and technical interviews (yes, even the dreaded “walk me through a DCF model” question), and leverage networking strategies to connect with alumni and professionals at target firms. You’ll also learn how to turn your internship into a full-time offer by exceeding expectations and building relationships with key decision-makers.

By the end of this guide, you’ll have a clear blueprint to navigate deadlines, avoid common pitfalls, and position yourself as a top candidate in the eyes of recruiters. Let’s dive in—your future in finance starts here.

Understanding the Finance Internship Landscape

A finance internship is your gateway to the world of investment banking, asset management, and corporate finance. But how do you get started?

This guide will show you:

- The key requirements for landing finance internships at firms like Goldman Sachs and J.P. Morgan.

- The best ways to develop essential skills such as financial modeling and portfolio management.

- The importance of building a strong professional network through LinkedIn and CFA Society events.

🔗 For more details on finance careers, check out Investopedia’s guide:

How to Start Your Career in Finance

To secure a competitive finance internship, you must first grasp the industry’s structure, employer expectations, and opportunities available to students from diverse backgrounds. This section breaks down the ecosystem to help you identify where you fit and how to position yourself effectively.

1: Types of Finance Internships

Finance internships vary widely across sectors, each offering unique experiences and skill-building opportunities. Here’s a breakdown of the most sought-after roles:

- Investment Banking Internships

- Focus: Mergers & acquisitions (M&A), IPOs, financial modeling.

- Top Firms: Goldman Sachs, Morgan Stanley, J.P. Morgan.

- Key Skills: Valuation techniques (DCF, comparables), pitch deck creation, long hours adaptability.

- Corporate Finance Internships

- Focus: Budgeting, financial planning & analysis (FP&A), internal reporting.

- Top Firms: Fortune 500 companies (e.g., Apple, Coca-Cola).

- Key Skills: Excel mastery, forecasting, stakeholder communication.

- Financial Analyst Internships

- Focus: Equity research, market analysis, portfolio support.

- Top Firms: BlackRock, Fidelity, Vanguard.

- Key Skills: Data analysis (Tableau, SQL), industry research, report writing.

- Wealth Management Internships

- Focus: Client relationship management, portfolio strategy, financial advising.

- Top Firms: UBS, Merrill Lynch, Charles Schwab.

- Key Skills: CRM tools, client pitching, regulatory compliance basics.

Why This Matters:

Understanding these roles helps you tailor your application materials and interview responses. For example, an investment banking internship will prioritize technical modeling skills, while wealth management values interpersonal abilities.

2: What Employers Look For

Finance recruiters seek candidates who blend technical prowess with soft skills. Here’s what tops their checklist:

- Hard Skills:

- Financial Modeling: Building DCF or LBO models in Excel.

- Data Analysis: Using tools like Excel, Python, or Bloomberg Terminal.

- Certifications: Progress toward CFA/FRM (for asset management) or CPA (for corporate finance).

- Soft Skills:

- Communication: Explaining complex concepts clearly (e.g., in mock client meetings).

- Teamwork: Collaborating on group projects or case competitions.

- Attention to Detail: Zero-error resumes and financial reports.

- Cultural Fit:

- Passion for Finance: Demonstrated through stock market clubs, finance blogs, or CFA Institute memberships.

- Resilience: Handling fast-paced, high-pressure environments.

Pro Tip:

Use your resume and interviews to show, not just tell. For example, mention a class project where you built a valuation model or a stock pitch competition you won.

3: Target Schools and Programs

While top firms often recruit heavily from Ivy League schools and elite business programs (e.g., Wharton, Stern), students from non-target schools can still break in with the right strategy:

- Feeder Programs:

- Schools like Harvard, Princeton, and NYU have long-standing ties to Wall Street firms.

- These programs often host exclusive networking events and on-campus interviews.

- Non-Target School Strategies:

- Leverage Online Platforms: Apply through LinkedIn or company websites to bypass campus recruiting.

- Compete in Finance Competitions: Win recognition through events like the CFA Research Challenge.

- Pursue Certifications: FRM or Excel certifications from Coursera/edX to stand out.

- Bridge Programs:

- Some firms (e.g., Bank of America) offer “diversity internships” or sophomore-specific programs to widen their talent pool.

Example:

A student from a state university landed a Morgan Stanley internship by cold-emailing alumni, completing a financial modeling course, and interning at a local wealth management firm.

Crafting a Winning Application

A competitive finance internship application requires precision, strategy, and a deep understanding of what recruiters prioritize. This section dives into the nuances of building a standout resume, writing a compelling cover letter, and mastering application logistics to ensure your submission rises to the top of the pile.

1: Building a Finance-Focused Resume

Your resume is your first impression—make it count. Finance recruiters spend seconds scanning applications, so every line must highlight relevant skills and achievements. Here’s how to structure it:

- Education Section:

- List your GPA (if 3.5+), relevant coursework (e.g., Financial Accounting, Derivatives), and academic honors.

- Mention finance-related clubs: “VP of Finance, University Investment Club – Managed a $10K student portfolio.”

- Technical Skills:

- Hard Skills: Excel (VLOOKUP, pivot tables), financial modeling, Bloomberg Terminal, SQL, Tableau.

- Certifications: In-progress or planned credentials (e.g., “CFA Level I Candidate” or “FMVA Certified”).

- Experience:

- Prioritize finance-related roles, even if non-traditional. For example:

- “Financial Analyst Intern, XYZ Startup – Built a DCF model to evaluate a $2M seed funding round.”

- “Accounting Assistant – Streamlined invoice processing, reducing errors by 15%.”

- Use action verbs: Analyzed, Optimized, Forecasted, Modeled.

- Prioritize finance-related roles, even if non-traditional. For example:

- Projects Section:

- Include class projects or independent work:

- “Valuation Project: Analyzed Tesla’s stock using comparable company analysis (Spring 2023).”

- “Case Competition: Won 2nd place in a national M&A pitch competition.”

- Include class projects or independent work:

Pro Tip:

Avoid generic terms like “detail-oriented.” Instead, show results: “Created a Monte Carlo simulation in Excel to forecast revenue, improving accuracy by 20%.”

2: Writing a Standout Cover Letter

A great cover letter bridges the gap between your resume and the firm’s needs. It should tell a story, not just repeat your resume.

- Structure:

- Opening: Hook with a passion statement.

“My fascination with mergers began during a university case study on Disney’s acquisition of 21st Century Fox—a project that solidified my desire to pursue investment banking at J.P. Morgan.” - Body: Align your skills with the role.

- “At [Previous Internship], I honed my financial modeling skills by building a leveraged buyout (LBO) model for a mid-market tech firm, which involved coordinating with senior analysts to validate assumptions.”

- Closing: Express enthusiasm and fit.

“I’m eager to contribute my analytical rigor and passion for fintech innovation to Goldman Sachs’ dynamic TMT team.”

- Opening: Hook with a passion statement.

- Tailoring to the Firm:

- Research the company’s recent deals or values. For example:

- For a BlackRock internship: “I admire your focus on sustainable investing, as demonstrated by the Climate Finance Partnership initiative.”

- For a corporate finance role: “I’m drawn to Coca-Cola’s global financial strategy, particularly your cost-optimization efforts in emerging markets.”

- Research the company’s recent deals or values. For example:

- Avoid These Mistakes:

- Generic phrases like “I’m a hard worker.”

- Overloading with jargon (keep it concise and clear).

- Failing to address the hiring manager by name (use LinkedIn to find them).

3: Navigating Application Deadlines

Timing is critical in finance internships. Miss a deadline, and you’ll lose out to candidates who planned ahead.

- Key Timelines:

- Summer Internships:

- Bulge Bracket Banks (Goldman Sachs, Morgan Stanley): Applications open in July/August for the following summer.

- Corporate Finance (Apple, Microsoft): Deadlines typically fall between September and November.

- Off-Cycle Internships: Smaller firms or boutique banks may recruit year-round.

- Summer Internships:

- Platforms to Monitor:

- Company career pages (set up alerts for “finance intern” roles).

- LinkedIn Jobs and Handshake (filter by “Entry Level” and “Finance”).

- Industry-specific sites: eFinancialCareers, Wall Street Oasis.

- Rolling vs. Fixed Deadlines:

- Rolling: Apply ASAP—roles fill quickly. Common at hedge funds and private equity firms.

- Fixed: Submit by the stated date. Common at large banks and Fortune 500 companies.

Pro Tip:

Create a spreadsheet to track deadlines, required materials (e.g., transcripts, letters of recommendation), and application statuses.

4: Leveraging Optional Materials

Some applications allow supplemental submissions to showcase your dedication:

- Writing Samples:

- Submit a stock pitch or equity research report (even from a class project).

- Portfolio:

- Link to a personal website or Google Drive folder with financial models, pitch decks, or coding projects (e.g., Python scripts for data analysis).

- Recommendation Letters:

- Request letters from professors or supervisors who can speak to your finance skills.

Acing the Finance Internship Interview

Landing a finance internship interview is a major milestone, but the real challenge lies in converting it into an offer. Finance interviews are notoriously rigorous, blending technical expertise, behavioral insights, and situational judgment. This section breaks down how to prepare for and excel in each phase of the interview process, ensuring you leave a lasting impression on recruiters.

1:Key Components of Finance Internship Interviews

Finance interviews typically include three core segments, each testing different skills:

- Technical Questions

- What to Expect:

- Valuation methods (DCF, comparables, precedent transactions).

- Financial statement analysis (e.g., “How do the three financial statements link?”).

- Excel proficiency (pivot tables, VLOOKUP, shortcuts like Alt + E + S + V for paste special).

- Market-related queries (e.g., “What’s the current 10-year Treasury yield?” or “Explain the impact of rising interest rates on M&A activity”).

- How to Prepare:

- Practice building a DCF model from scratch using real-world data (e.g., analyze a public company like Tesla).

- Use platforms like Wall Street Prep or Breaking Into Wall Street for technical drills.

- Stay updated on market trends via Bloomberg, Financial Times, or CNBC.

- What to Expect:

- Behavioral & Fit Questions

- What to Expect:

- “Walk me through your resume.”

- “Describe a time you led a team under pressure.”

- “Why do you want to work at [Goldman Sachs/J.P. Morgan]?”

- How to Prepare:

- Use the STAR method (Situation, Task, Action, Result) to structure answers.

- Research the firm’s culture and recent deals (e.g., mention J.P. Morgan’s sustainability initiatives if interviewing there).

- Align your answers with the firm’s values (e.g., teamwork for Goldman Sachs, innovation for fintech startups).

- What to Expect:

- Case Studies & Brainteasers

- What to Expect:

- On-the-spot valuation exercises (e.g., “Value a coffee shop in this airport”).

- Brainteasers (e.g., “How many golf balls fit in a Boeing 747?”).

- How to Prepare:

- Practice breaking down problems methodically (e.g., estimate market size, costs, revenue streams).

- Use frameworks like MECE (Mutually Exclusive, Collectively Exhaustive) to structure your analysis.

- What to Expect:

2: Step-by-Step Preparation Strategy

- Master Technical Fundamentals

- Tools to Use:

- Excel: Drill shortcuts and complex functions (e.g., XLOOKUP, INDEX-MATCH).

- Bloomberg Terminal: Familiarize yourself with equity screening and economic data (access via university labs or free Bloomberg Market Concepts courses).

- Resources:

- Books: Investment Banking by Rosenbaum & Pearl, Valuation by McKinsey.

- Online Courses: Coursera’s Financial Markets by Yale University.

- Tools to Use:

- Conduct Mock Interviews

- With Peers: Simulate interviews with finance club members, focusing on time-bound technical questions.

- With Professionals: Use platforms like LinkedIn or alumni networks to connect with current analysts for practice sessions.

- Record Yourself: Identify and eliminate verbal tics (e.g., “um,” “like”) and refine body language.

- Develop a Storytelling Edge

- Resume Narratives: Turn bullet points into compelling stories. For example:

- Instead of “Built financial models,” say, “Developed an LBO model for a $5M acquisition that identified 20% cost-saving opportunities.”

- Passion Projects: Highlight finance-related hobbies (e.g., managing a personal stock portfolio, writing a Substack on market trends).

- Resume Narratives: Turn bullet points into compelling stories. For example:

3: Common Pitfalls to Avoid

- Overlooking Firm-Specific Nuances:

- A private equity firm like Blackstone cares deeply about LBO models, while a corporate finance role at Coca-Cola prioritizes budgeting and forecasting. Tailor your prep accordingly.

- Underestimating Soft Skills:

- Even perfect technical answers won’t save you if you lack communication skills or cultural fit. Practice explaining complex concepts simply.

- Failing to Follow Up:

- Send a thank-you email within 24 hours, reiterating your interest and referencing a topic discussed (e.g., “I enjoyed our conversation about ESG investing trends”).

4: Pro Tips for Interview Day

- Attire: Stick to formal business wear (suit and tie for men, pantsuit or conservative dress for women).

- Questions to Ask:

- “What’s the most challenging project your team has tackled recently?”

- “How do you see [AI/sustainable finance] impacting this role in the next 5 years?”

- Mindset: Treat it as a two-way conversation—interviewers assess if you’re someone they’d want to work with daily.

Turning Your Internship into a Full-Time Role

Securing a finance internship is only half the battle—converting it into a full-time offer requires strategic effort, visibility, and alignment with the firm’s long-term goals. In competitive sectors like investment banking, asset management, or corporate finance, employers use internships as a “try before they buy” opportunity. This section details how to maximize your performance, build internal advocates, and navigate post-internship protocols to transform your temporary role into a permanent position.

1: Exceeding Expectations During the Internship

Your primary goal is to prove you’re indispensable. Here’s how to stand out:

1. Deliver Flawless Core Work

- Accuracy Over Speed:

- Double-check financial models, reports, and data entries. A single error in a valuation model can undermine trust.

- Example: “An intern at J.P. Morgan caught a $10M discrepancy in a client’s EBITDA calculation during due diligence, earning a full-time offer.”

- Master Firm-Specific Tools:

- Become the go-to expert on tools like Bloomberg Terminal, FactSet, or the company’s proprietary software.

2. Take Initiative Beyond Your Role

- Volunteer for High-Impact Projects:

- Ask to assist with live deals, earnings reports, or client presentations.

- Example: “An RBC intern developed a macro-driven dashboard in Excel to track sector-specific risks, which the team now uses quarterly.”

- Identify Pain Points:

- Propose solutions for inefficiencies (e.g., automate repetitive tasks using Excel macros or Python scripts).

3. Showcase Core Finance Skills

- Technical Excellence:

- Use financial modeling to solve real problems (e.g., “Built a merger model to assess the synergies of a potential acquisition”).

- Soft Skills:

- Communicate complex ideas clearly in meetings.

- Collaborate across teams (e.g., work with compliance to streamline reporting).

Pro Tip:

Track your contributions in a “brag sheet” (e.g., tasks completed, positive feedback, hours saved). This becomes critical for performance reviews.

2: Building Relationships with Key Decision-Makers

Your manager’s endorsement is vital, but don’t stop there:

1. Cultivate a Mentor-Mentee Dynamic

- Schedule Regular Check-Ins:

- Ask for feedback every 2–3 weeks: “How can I improve my pitch deck formatting?” or “What skills should I focus on to add more value?”

- Express Long-Term Interest:

- Example: “I’d love to continue contributing to the renewable energy team post-graduation. What steps would you recommend I take?”

2. Network Horizontally and Vertically

- Peers: Build rapport with junior analysts—they often have sway in hiring discussions.

- Senior Leaders:

- Attend firm-wide events (e.g., town halls, happy hours) and introduce yourself to VPs or MDs.

- Example: “A BlackRock intern asked a Portfolio Manager for advice on ESG trends during a coffee chat—later, that PM advocated for her hire.”

3. Align with the Firm’s Culture

- Adopt Core Values:

- At Goldman Sachs, emphasize teamwork; at a startup, highlight adaptability.

- Dress and Communicate the Part:

- Mirror the firm’s norms (e.g., formal attire in traditional banks vs. business casual in fintech).

3: Navigating the Formal Conversion Process

Most structured programs have defined evaluation criteria. Understand and leverage them:

1. Ace Midpoint and Final Reviews

- Prepare a Self-Evaluation:

- Highlight quantifiable wins (e.g., “Reduced monthly reporting time by 25% using pivot tables”).

- Address Feedback Proactively:

- If told to improve presentation skills, volunteer to lead the next team meeting.

2. Understand the Offer Timeline

- Bulge Bracket Banks: Offers are typically extended 1–2 weeks post-internship.

- Corporate Finance: Decisions may take longer (4–6 weeks) as budgets are approved.

3. Handle “The Talk” with Your Manager

- Express Interest Early:

- Midway through the internship, say: “I’ve loved contributing to the team and would be thrilled to stay on full-time. What can I do to make that happen?”

- If No Formal Conversion Exists:

- Propose a role: “I’ve noticed the team is expanding into emerging markets—I’d love to support that initiative.”

4: Post-Internship Follow-Up

Even if an offer isn’t immediate, stay on the firm’s radar:

1. Send a Thoughtful Thank-You Note

- Personalize It:

- “Thank you for teaching me how to optimize DCF models—your patience helped me grow immensely.”

- Reinforce Your Value:

- “I’d welcome the chance to continue streamlining the quarterly budgeting process.”

2. Maintain Relationships

- LinkedIn Engagement:

- Comment on your manager’s posts or share industry news relevant to their work.

- Quarterly Updates:

- Email brief progress notes (e.g., “I passed the CFA Level I exam!” or “I’ve been practicing advanced Excel macros we discussed”).

3. Reapply Strategically

- Leverage Referrals:

- Ask your former manager to refer you for full-time roles.

- Mention the Internship in Applications:

- Example: “As a summer analyst at Morgan Stanley, I developed a passion for M&A—I’m eager to bring that experience to your team.”

Case Study: From Intern to Full-Time Analyst at Goldman Sachs

Background: A 2023 intern at Goldman’s IBD division.

Actions Taken:

- Volunteered to work on a weekend deal team during a critical acquisition.

- Built a custom Excel add-in to automate formatting of pitch books.

- Requested monthly feedback sessions with their VP mentor.

Result: Received a full-time offer with a signing bonus.

Conclusion: Your Path to a Finance Internship Starts Now

The journey to securing a competitive finance internship is not a distant dream—it’s a tangible goal within your reach. But success hinges on one non-negotiable truth: you must start now. The finance industry moves at lightning speed, and firms like Goldman Sachs, J.P. Morgan, and BlackRock are already scouting for candidates who demonstrate initiative, technical prowess, and relentless drive.

This guide has armed you with the tools to stand out:

- Preparation: Sharpen your financial modeling skills, master Excel, and stay ahead of market trends.

- Persistence: Embrace rejection as feedback, refine your approach, and keep applying.

- Networking: Transform LinkedIn connections into mentors and coffee chats into job referrals.

But knowledge alone won’t land you the role—action will. Update your resume today. Draft that cold email to a Morgan Stanley alum. Practice a DCF model until it’s second nature. Every small step you take now compounds into the confidence and competence that recruiters demand.

Remember, internships at top firms are more than resume boosters—they’re gateways to full-time roles, mentorship, and career-defining opportunities. The student who starts preparing sophomore year will always outpace the one who scrambles senior year.

So, what’s your next move?

- This week: Revamp your LinkedIn headline and connect with three professionals in your target field.

- This month: Complete a financial modeling course or attend a CFA Society webinar.

- This semester: Apply to at least five internships, tailoring each application to the firm’s values.

The road to Wall Street—or any finance hub—is paved with deliberate effort. But with this roadmap, you’re not just walking it; you’re sprinting.

Your future in finance isn’t waiting. It’s yours to claim—starting today. here